What support are you entitled to?

As a public health crisis grips Australia, various public and some major private institutions have begun offering economic and financial assistance to affected individuals and businesses.

1. FEDERAL GOVERNMENT

JobKeeper Payment

The Government announced on 30 March 2020 its newest and most substantial economic stimulus measure to date. It is known as the “JobKeeper” payment and will cost $130 billion over the next six months. This is as part of the Commonwealth’s hibernation strategy to ensure that businesses that are affected by the economic downturn are able to be effectively put on hold, in such a way to allow quick recommencement after the crisis passes. Approximately six million workers will be eligible for a fortnightly payment of $1500 (before tax) through their employer for up to six months.

Eligibility Criteria

- Employers are eligible for the subsidy if:

- Their business turnover is less than $1 billion and has reduced by more than 30 per cent relative to a comparable period (of at least one month) a year ago; or

- Their business turnover exceeds $1 billion and their turnover has reduced by more than 50 per cent relative to a comparable period (of at least one month) a year ago and is not one of the five largest banks

- Self-employed individuals are also eligible where they have suffered a 30 per cent decline in turnover compared to a comparable period (of at least one month) a year ago

- Eligible employers will receive the payment for each employee that was on their books on 1 March 2020 and continues to be engaged by the employer – this includes full time, part time and casuals who have been with their employer for at least the 12 months prior to 1 March 2020.

- Eligible employees must be at least 16 years of age and be:

- Australian Citizens; or

- Holder of Permanent visa; or

- Protected Special Category Visa Holder; or

- Special Category (444) Visa Holder; or

- A non-protected Special Category Visa Holder – who has been residing continually in Australia for 10 years or more

- Employers that stood down their employees before the commencement of this scheme are able to participate

- Employees that are re-engaged by their employer after 1 March 2020 are also eligible

- Individuals that are employed by multiple organisations aren’t eligible for multiple Job Keeper payments, they will only be eligible to receive it from their primary employer (usually indicated by which one they claim their tax-free threshold from)

- Eligible employers must register for the scheme through an application to the Australian Tax Office and provide supporting information to demonstrate the downturn in their business. Employers can register their interest in participating on the ATO website by clicking here. Note that formal registration will not start until the measures are legislated and assented in the coming days.

Payment and How it Works

- For most businesses, the ATO will use Single Touch Payroll (STP) data to gather employee details for eligible businesses

- Eligible employers will be paid $1,500 per fortnight per eligible employee

- Employees will receive a minimum of $1,500 per fortnight, before tax and employers are able to top up this amount as they wish.

- Key rules:

- If an employee ordinarily receives in excess of $1,500 per fortnight before tax, they will continue to receive their regular income, with the $1,500 per fortnight, assisting the employer to subsidise all or part of the income of the employee(s).

- If an employee ordinarily receives less than $1,500 per fortnight before tax or has been stood down or had employment cease after 1 March 2020, but re-engaged by the same eligible employer, the employer must pay them a minimum $1,500 per fortnight, before tax

- It is entirely the employer’s discretion whether they want to pay superannuation on additional wages because of the Job Keeper payment.

- Payments will be made to the employer with a one-month delay by the ATO. The subsidy will start on 30 March 2020 with first payments to be received by employers in the first week of May.

- Individuals that applied for the Jobseeker allowance and the Coronavirus supplement are required to notify Services Australia that they are receiving the Job Keeper payment and will likely be made ineligible for the Jobseeker allowance and Coronavirus supplement as a result.

Example

John is a casual employee at a Gym, he was made redundant in mid-March due to government directives that Gyms close. He had been employed at the Gym for over 12 months, earning $1,000 a fortnight. John registered an intent to claim the JobSeeker Payment and Coronavirus Supplement with Services Australia and was eligible for about $1,100 a fortnight.

In response to the JobKeeper payment, the Gym he was employed at, decides to re-engage him, so they are ready to resume operations once restrictions are lifted. If John agrees to go back, he will receive $1,500 a fortnight before tax whilst he is stood down. He is required to advise Services Australia that he is receiving the JobKeeper payment, as a result he is no longer eligible to receive the JobSeeker Payment and Coronavirus Supplement as he exceeds the income threshold.

How to Apply

To register for updates about the JobKeeper Payment with the ATO and to be notified when applications open visit here.

For more information about the JobKeeper payment visit here.

Note that the JobKeeper payments are currently unlegislated but are expected to pass Parliament and receive Royal Assent in the coming days.

For an easy-to-digest guide, download our JobKeeper Snapshot here.

Other Federal Government Stimulus Packages

Wave 1

On March 12, the Prime Minister Hon Scott Morrison MP and Treasurer Hon Josh Frydenberg MP announced the Commonwealth government’s economic response to the Coronavirus (COVID-19) pandemic. The package totals $17.6bn over the forward estimates and is focused on supporting business and protecting jobs in the Australian economy. The economic stimulus package targets four key areas:

Support for business investment

- Increasing and expanding the instant asset write off –

- The Government will increase the instant asset write off threshold from $30,000 to $150,000 as of today (12th March 2020) until the 30th of June 2020

- The program will be expanded to be used by all businesses with aggregated annual turnover less than $500m (up from $50m) until the 30th of June 2020

- Accelerated Depreciation Deductions –

- The Government will accelerate depreciation deductions, by allowing all businesses with turnover less than $500m to deduct 50% of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost.

How to Apply

- You’ll automatically receive this credit upon lodgement of your 2020 income tax return.

Cash flow assistance for businesses

- Boosting cash flow for employers

- Businesses with turnover less than $50m that employ staff will be eligible for a payment up to $25,000.

- This will be delivered by the ATO upon lodgement of monthly or quarterly activity statements depending upon the businesses reporting frequency:

- Quarterly:

- Quarter 3 – January 2020 to March 2020

- Quarter 4 – April 2020 to June 2020

- Monthly:

- March 2020*

- April 2020

- May 2020

- June 2020

- Quarterly:

- How is it calculated:

- Businesses that employ individuals will be entitled to a minimum payment of $2,000 even if they don’t withhold any wages tax

- The payment will be tax free

- The payment is calculated as 50% of wages tax withheld up to a maximum of $25,000

- * To provide a similar treatment to quarterly lodgers, the payment for monthly lodgers for March 2020 monthly BAS’ or IAS’ will be calculated at three times the rate (150%) of wages tax.

- How to Apply

- The ATO will automatically calculate the benefit when the BAS or IAS is lodged, and the benefit will be subtracted from the debt, or if a refund is due, it will be paid within 14 days.

- Supporting Apprentices and Trainees

- The government is supporting small business to retain apprentices and trainees with a 50% wage subsidy on apprentice or trainee wages paid from 01/01/2020 to 30/09/2020.

- Where a business does not retain an apprentice, the subsidy is available to a new employer.

- Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter)

- Eligibility:

- It is only eligible to small businesses employing fewer than 20 full-time employees

- The apprentice or trainee must have been in training with a small business as at 1 March 2020

- Employers of any size can access the subsidy, by re-engaging an eligible out-of-trade apprentice or trainee

- How to Apply

- In order to get the subsidy, a business must first be assessed by an Australian Apprenticeship Support Network (AASN) provider

- Employers will be able to register for the subsidy from early-April 2020, with final claims for payment due by 31 December 2020.

- For more information visit:

Assistance of households

- Stimulus Payments

- The Australian government will provide a one-off $750 payment to 6.5 million social security, veteran and other income support recipients.

- To be eligible, an individual must be receiving one of the following payments or hold one of the following concession cards on 12 March 2020:

- Age Pension

- Family Tax Benefit, including Double Orphan Pension

- Pensioner Concession Card Holders

- Newstart Allowance

- Youth Allowance

- Disability Support Pension

- Carer Payment

- Parenting Payment

- Wife Pension

- Widow B Pension

- ABSTUDY (Living Allowance)

- Austudy

- Bereavement Allowance

- Sickness Allowance

- Partner Allowance

- Special Benefit

- Widow Allowance

- Carer Allowance

- Commonwealth Seniors Health Card Holders

- Veteran Service Pension

- Veteran Income Support Supplement

- Veteran Compensation Payments (including lump sum payments)

- War Widow(er) Pension

- Veteran Payment

- Veteran Gold Card Holders

- Farm Household Allowance

How to Apply

- The one-off payment will be paid automatically from 31 March 2020 by Services Australia. Over 90% of payments will be made by mid-April 2020.

- If you hold a Commonwealth Seniors Health Card or Veteran Gold Card, the department will contact you to confirm your account details, so the payment can be made.

Assistance for severely affected regions

- Support for Coronavirus-affected regions and communities:

- The government has set aside $1 billion to support regions and communities that have been disproportionately affected by the economic impacts of the coronavirus, particularly those in industries of tourism, agriculture and education.

- Government will also seek to provide additional assistance to business to assist business in identifying alternative export markets or supply chains.

- The $1 billion will be provided through existing or newly established Government programs with the Minister for Trade, Tourism and Investment working with industries and communities to determine how the money will be spent.

- ATO administrative relief

- The ATO will provide administrative relief for certain tax obligations (similar to those provided during the bushfires) to taxpayers affected by the Coronavirus outbreak on a case by case basis.

For more information about the Economic Response to the Coronavirus, please visit here.

Wave 2

On Sunday the 22nd of March 2020, the Prime Minister and the Treasurer announced a second round of further stimulus to address the significant economic consequences associated with new measures to contain the Coronavirus outbreak. The second wave is expected to increase total Government spending on stimulus to $63.8bn (up from $17.6bn) over the forward estimates. However, total fiscal and balance sheet support will total $189bn over the forward estimates. The Government has indicated that this is unlikely to be the last wave of stimulus. Nonetheless, much of the stimulus discussed is still subject to Legislative approval and Royal Assent, which is expected to be granted this week.

Boosting Cash Flow for Businesses

- The Government is expanding their cash relief package for business from the first wave of stimulus to now cover 100 per cent of wages tax withheld (up from 50 per cent) for businesses with turnover up to $50 million.

- The maximum payment will be increased from $25,000 to $100,000 and minimum payments increased from $2,000 to $20,000.

- Unlike what was announced earlier, it will include an additional payments for activity statements for June 2020 up to and including September 2020.

- This will be a tax free payment, that will be automatically calculated by the ATO when Business Activity Statements or Instalment Activity Statements are lodged.

- The payment will be calculated to cover 100% of Wages Tax withheld of the following quarters up to $50,000 cumulative, with a minimum payment of $10,000:

- For Quarterly Lodgers:

- March Quarter 2020

- June Quarter 2020

- For Monthly Lodgers:

- March 2020*

- April 2020

- May 2020

- June 2020

- For Quarterly Lodgers:

* Calculated at 300% Wages Tax withheld for March 2020

- The additional payment will be:

- For Quarterly lodgers: 50% of the total amount received from the first round of payments for each of the two quarters (up to $50,000 cumulative):

- June Quarter 2020

- September Quarter 2020

- For Monthly lodgers: 25% of the total amount received from the first round of payments for each of the four months (up to $50,000 cumulative):

- June 2020

- July 2020

- August 2020

- September 2020

- For Quarterly lodgers: 50% of the total amount received from the first round of payments for each of the two quarters (up to $50,000 cumulative):

How to Apply

- You’ll automatically receive this credit upon lodgement of your BAS and IAS by Khourys & Associates.

Temporary relief for financially distressed businesses

- The Government is increasing the minimum threshold that creditors can issue a statutory demand on a company under the Corporations Act 2001 from $2,000 to $20,000 for the next six months.

- The statutory timeframe for a company to respond to a statutory demand will be extended from 21 days to six months. This will apply for the next six months.

- The minimum threshold to commence bankruptcy proceedings against a debtor will temporarily increase from $5,000 to $20,000 for the next six months.

- The time a debtor has to respond to a bankruptcy notice will be temporarily increased from 21 days to six months. This will apply for six months.

- If a debtor makes a declaration of intention to present a debtor’s petition (intention to enter voluntary bankruptcy), the period which unsecured creditors cannot take further action to recover debts will be temporarily extended from 21 days to six months. This will apply for six months.

- The Government will relieve directors of personal liability from trading while insolvent with respect to debts incurred in the ordinary course of a company’s business. Note that egregious cases of dishonesty and fraud will still be subject to criminal penalty. This will apply for six months.

How to Apply

- Contact us so we can approach the ATO to request assistance on your behalf, and if eligible, the ATO will ‘tailor’ an assistance package for you.

Support for Individuals and Households

- In addition to the first $750 payment to social security recipients and eligible concession card holders announced in the first wave of stimulus to be paid from 12th of March 2020; the government will provide a second payment of $750 from 10th of July 2020. These payments are tax exempt.

- Note that eligibility criteria for the second $750 payment excludes individuals receiving the Coronavirus supplement discussed below.

- The Government will establish a new temporary Coronavirus supplement to be paid at the rate of $550/fortnight, to be paid on top of new and existing payments of the Jobseeker payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit

- The Jobseeker and Youth Allowance Jobseeker payments will provide money to individuals who are stood down or lose employment, as well as sole traders, the self-employed, casual and contract workers who meet the income test.

- Asset Testing for the Jobseeker, Youth Allowance Jobseeker and Parenting Payment will be waived for the duration of the Coronavirus supplement.

- Note: Individuals will not be permitted to access employer entitlements (such as annual leave or sick leave) or Income Protection insurance whilst receiving the Jobseeker or Youth Allowance Jobseeker payment.

- The Coronavirus Supplement and expanded access for payments will commence from the 27th of April 2020

How to Apply

- Individuals are encouraged to apply for these payments online or by calling Services Australia to minimise the need to visit a Services Australia office.

Early Access to Superannuation

- Eligible individuals will be permitted to access up to $20,000 super – $10,000 in 19-20 and an additional $10,000 in 20-21 from their super balance if they are severely financially affected by the Coronavirus.

- Eligibility:

- You are unemployed; or

- You are eligible to receive a job seeker or youth allowance for jobseekers payments, parenting payment, special benefit or farm household allowance; or

- on or after 01/01/2020:

- You were made redundant; or

- Your working hours were reduced by 20 per cent or more; or

- If you are a sole trader – your business was suspended or there was a reduction in your turnover of 20 per cent or more.

How To Apply

- You can apply to release your superannuation through MyGov online, with applications opening from mid-April 2020.

- Individuals releasing money from Superannuation will not need to pay tax on amounts released and it will not affect Centrelink payments.

Providing Support for Retirees

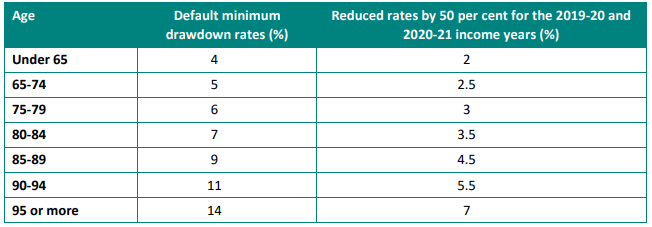

- The Government is temporarily reducing superannuation minimum draw down requirements by 50 per cent for 2019-20 and 2020-21. This is to reduce the need for retirees to sell investment assets to fund drawdown requirements.

- The Government is also reducing deeming rates by a further 0.25% in addition to 0.5% reduction announced in the first wave of stimulus. This will take effect on the 1st of May 2020. The upper deeming rate will be 2.25% and the lower deeming rate 0.25%. The average pensioner will receive $105 more over 12 months because of the changes.

Supporting the flow of Credit

- The Commonwealth will provide a guarantee of 50% on new unsecured loans to Small and Medium sized businesses to be used for working capital.

- Only businesses with less than $50 million turnover are eligible for these loans.

- The maximum loan size is $250,000 and up to three years, commencing with an initial six-month repayment holiday.

- Loans will still be subject to a lender’s credit assessment.

- The scheme will commence from early April 2020 and apply on new loans to small and medium business up until 30th September 2020

- The Commonwealth is also providing an exemption from responsible lending obligations for lenders providing credit to existing small business customers. This exemption is for six months and should help small and medium business access credit quicker and more efficiently.

- The Government is providing the Australian Office of Financial Management (AOFM) $15 billion to invest in primary market securitisations (such as mortgage backed securities) in order to assist smaller lenders that will not benefit from the RBA’s term funding facility. This will help ensure that small lenders maintain access to funding and that they can continue to compete in the lending market.

- The Australian Prudential Regulation Authority (APRA) is relaxing its expectations regarding the maintenance of bank’s capital ratios to support new lending to businesses and individuals.

Support for Australian Airlines and Airports

- The Government will provide commercial and aeromedical aircraft operators with relief from aviation fuel tax excise and equivalent customs duty from 1st February 2020 for a period of 8 months.

- The Government will also provide the domestic aviation industry relief from Air services Australia charges as well as domestic aviation security costs from 1st February 2020 for 8 months through providing a rebate to cover costs.

For more information about the government’s economic response, visit here.

2. NSW STATE GOVERNMENT

The NSW Government announced on Tuesday the 17th of March its own $2.3bn health and economic stimulus package including:

- $700m in extra funding for NSW Health as they seek to double the State’s Intensive Care Unit capacity as well as fund additional COVID-19 testing kits, medical equipment and bringing forward elective surgeries to private hospitals.

- $450m to waive payroll tax for businesses with payroll up to $10m for the June Quarter (April 2020 to June 2020).

- $56m to bring forward the next round of payroll tax cuts by raising the threshold limit to $1 million for 2020-2021 instead of 2021-2022

- $80m to waive a range of fees and charges for small businesses particularly for bars, cafes restaurants and tradies.

- $250m to employ additional cleaners on public infrastructure.

- $500m to bring forward capital works and maintenance.

For more information on the response by the NSW Government, visit here.

How to Apply

- These will be automatically applied for the payroll tax returns for the aforementioned periods.

3. THE AUSTRALIAN TAX OFFICE

The ATO has announced a raft of administrative relief measures, targeted at easing stress associated with meeting business tax obligations, these include:

- Payment Deferrals – Allowing affected businesses to defer some payments and vary instalments for income tax, activity statements, FBT and excise payments by up to six months.

- Monthly GST Credits – Businesses with GST turnover less than $20m can choose to switch GST reporting to monthly, instead of quarterly to access any GST refunds due quicker and revert back 12 months later if they wish.

- PAYG Instalments – Affected businesses will be permitted to vary their PAYG instalment rates or amounts lower and also claim refunds for instalments paid for the September 19 and December 19 Quarters.

- Remission of Interest and Penalties – Affected businesses may be eligible for remission of interest and penalties applied to tax liabilities after the 23rd of January 2020, on a case by case basis.

- Low Interest Payment Plans – The ATO will make low interest payment plans available for businesses to meet their ongoing tax liabilities.

- Super Guarantee Payments – Note that Employers will still be expected to meet Super Guarantee obligations for their employees and legally the ATO is not permitted to change contribution due dates or waive the super guarantee charge (SGC) where super guarantee payments are late or unpaid.

- The ATO will also be able to assist businesses in distress by offering additional support on a case by case basis.

For more information visit here.

How to Apply

- Contact us so we can approach the ATO to request assistance on your behalf, and if eligible, the ATO will ‘tailor’ an assistance package for you.

4. THE RESERVE BANK OF AUSTRALIA

The RBA held an out of cycle meeting on Thursday the 19th of March and resolved to cut the cash rate in half to a record low of 0.25%. In addition, the RBA announced that it would commence its first ever quantitative easing program in its history, preparing to commence the purchasing of Commonwealth Government bonds from tomorrow. The RBA will further prop up the banking system, by offering lenders a three-year funding facility worth at least $90 billion and access to additional monies if they increase lending to business, in particular small and medium sized businesses.

Banks are responding to this decision by the RBA by reducing interest rates on their various loans, however there are differences between lenders, and it is important to check directly with your bank to see how much you will benefit.

5. BANKS

Many banks are offering support for affected businesses by allowing customers to:

- Deferring repayments on some business loans including equipment finance for up to 6 months

- Offering fee waivers affected customers, including early redraw fees of some term deposits or merchant terminal fees.

To find out what your bank is offering, search online or contact them directly. Note that it is unlikely that deferrals or fee waivers are automatically granted, and they are often assessed on a case by case basis by the bank. For more information about what your bank is doing, check their website:

6. TELECOMMUNICATIONS

The major Telcos are also assisting customers by offering additional data as they find themselves working from home. Most carriers are offering this support to the broader public and not just individuals directly impacted by the virus. To find out more, check with your provider: